What Else Besides Earnings Come With the Back Part

Japan – Taxation of international executives

Taxation of international executives

Taxation of international executives

- 1000

Overview and Introduction

Individual income taxes in Japan consist of a national income tax and a local inhabitant tax. Japan also imposes gift and inheritance taxes. A Japanese permanent resident is taxed on worldwide income with reference to progressive tax rates. A non-permanent resident is taxed on the greater of Japanese-source income or the amount paid in and/or remitted to Japan. Foreign tax credits are available for taxpayers who is categorized as a "Resident" from Japanese tax perspective. Japan has an extensive tax treaty network which mitigates double taxation. Japan has a floating exchange rate so that the value of the Japanese Yen varies with market forces.

The official Japanese currency is the Japanese Yen (JPY).

Herein, the host country/jurisdiction refers to the country/jurisdiction to which the employee is assigned. The home country/jurisdiction refers to the country/jurisdiction where the assignee lives when they are not on assignment.

Back to top

Income Tax

Tax returns and compliance

When are tax returns due? That is, what is the tax return due date?

15 March of the following year. Extensions of the filing deadline are generally not allowed.

What is the tax year-end?

31 December.

What are the compliance requirements for tax returns in Japan?

Residents

Spouses are not taxed jointly; each individual is treated as a separate taxpayer. All taxpayers (including spouses and children) file tax returns separately. Income of children is filed on separate returns.

An individual tax return must be filed if income exceeds a specified amount. A resident taxpayer who receives employment income from outside of Japan is required to file a tax return.

A resident taxpayer is required to file a final return for each calendar year by 15 March of the following year and pay income tax. If a resident taxpayer leaves Japan, the individual must file a tax return before the departure date or by 15 March of the following year if a tax agent is appointed before the departure date. An exception applies for a person whose total salary has been subjected to year-end adjustment of withholding tax.

Non-residents

A non-resident taxpayer, whose employment income has not been subject to a 20.42 percent withholding tax, must file a return by the day of their departure from Japan, or by 15 March of the following year if a tax agent is appointed, and pay the 20.42 percent tax.

Tax rates

What are the current income tax rates for residents and non-residents in Japan?

Residents

The following tax rates are applied to total taxable income, which is total income minus allowable deductions. These apply to both permanent and non-permanent resident taxpayers:

National income tax table for 2021 in Japanese yen (JPY)

| Taxable income bracket | Tax rate on income in bracket | Deductions after applying the tax rate on taxable income. | |

| From JPY | To JPY | Percent | JPY |

| 0 | 1,950,000 | 5 | 0 |

| 1,950,001 | 3,300,000 | 10 | 97,500 |

| 3,300,001 | 6,950,000 | 20 | 427,500 |

| 6,950,001 | 9,000,000 | 23 | 636,000 |

| 9,000,001 | 18,000,000 | 33 | 1,536,000 |

| 18,000,001 | 40,000,000 | 40 | 2,796,000 |

| 40,000,001 | and above | 45 | 4,796,000 |

Local inhabitants tax table for 2021

To increase tax revenue to finance post-earthquake reconstruction, 2.1 percent temporary surtax on National income tax is in effect for 25 years (from 2013 to 2037) in addition to the above tax rates.

| Taxable income bracket | Total tax on income below bracket | Tax rate on income in bracket | |

| From JPY | To JPY | JPY | Percent |

| Prefectural | |||

| 0 | No limit | 0 | 4* |

| Municipal | |||

| 0 | No limit | 0 | 6* |

*This is the case the taxpayer registers their residence in Tokyo. The tax rate varies depends on local tax laws.

Non-residents

A non-resident is taxed at a flat rate of 20 (20.42 including surtax) percent on the gross salary and allowances attributable to sources in Japan without deductions.

Residence rules

For the purposes of taxation, how is an individual defined as a resident of Japan?

According to the Income Tax Law of Japan, there are two categories of individual taxpayers, a resident and a non-resident.

Resident

A resident is an individual who has a living base in Japan or has resided in Japan for a continuous period of 1 year or more. A resident is further classified as either a non- permanent resident or a permanent resident.

Permanent and non-permanent resident

A non-permanent resident is a resident who is not a Japanese national and has a living base in Japan or has resided in Japan for more than 1 year and 5 years or less in the last 10 years.

A non-permanent resident is taxed on the income other than foreign-source income under the Japan tax law, regardless of where it is paid, and the foreign source income paid in, or remittance into Japan.

Income other than foreign source income includes capital gain from securities transaction outside Japan which was acquired after 1 April 2017 when tax resident in Japan and sold during resident period. This will be considered as Japanese taxable income even though the income from gain is not remitted into Japan.

A permanent resident is a resident who is a Japanese national or who has a living base in Japan or resided in Japan for more than 5 years in the last 10 years.

A permanent resident is subject to income tax on worldwide income regardless of source.

Non-resident

A non-resident is an individual other than resident.

A non-resident is taxed only on Japanese-sourced income, without deductions or exemptions.

If a non-resident is a resident of a country/jurisdiction with which Japan has concluded a tax treaty, income may be either exempt or subject to a lower rate of tax.

Is there, a de minimis number of days rule when it comes to residency start and end date? For example, a taxpayer can't come back to Japan for more than 10 days after their assignment is over and they repatriate.

No.

What if the assignee enters Japan before their assignment begins?

This will depend on the individual circumstances of the assignee and the treaty provisions in place. Resident period in Japan generally commences from the day following the date the assignee arrives in Japan to start the assignment.

Termination of residence

Are there any tax compliance requirements when leaving Japan?

The tax office notes a taxpayer's entry in Japan from the residency management system with a municipality. Tax return must be filed before departure or alternatively, the taxpayer must appoint a tax agent by notice to the tax office before departure.

If a taxpayer did not declare the departure from Japan and failed to remove their residency status from the management system at the local ward office, local inhabitant tax could be assessed.

What if the assignee comes back for a trip after residency has terminated?

As above, this will depend on the individual circumstances of the assignee and the treaty provisions in place.

Communication between immigration and taxation authorities

Do the immigration authorities in Japan provide information to the local taxation authorities regarding when a person enters or leaves Japan?

In general, no. However, tax authorities can obtain the information from immigration authorities.

Filing requirements

Will an assignee have a filing requirement in Japan after they leave Japan and repatriate?

Depending on the timing of departure and whether or not they receive any income post departure which relates to their Japan assignment. In this case, non-resident tax return/withholding is required.

Economic employer approach

Do the taxation authorities in Japan adopt the economic employer approach 1 to interpreting Article 15 of the Organisation for Economic Co-operation and Development (OECD) treaty? If no, are the taxation authorities in Japan considering the adoption of this interpretation of economic employer in the future?

The taxation authorities in Japan currently do not adopt the economic employer approach. However, the authority would look for facts and circumstances whether the individual concerned would provide services for the Japan entity in question.

De minimus number of days

Are there a de minimis number of days 2 before the local taxation authorities will apply the economic employer approach? If yes, what is the de minimis number of days?

Not applicable.

Types of taxable compensation

What categories are subject to income tax in general situations?

There are two types of individual taxes in Japan, a National Income Tax (NIT) and a Local Inhabitant Tax (LIT).

Both types of taxes are based on the same income items.

However, the types of deductions allowed against income differ for the two taxes. Below is a table showing the general income and deduction items for both taxes:

| Income items | Subject to: | |

| NIT | LIT* | |

| Employment income | Y | Y |

| Business income | Y | Y |

| Rental income | Y | Y |

| Dividend income | Y | Y |

| Capital gains | Y | Y |

| Occasional income | Y | Y |

| Miscellaneous income | Y | Y |

| Interest income | Y | Y |

| Retirement income | Y | Y |

| Income from forestry | Y | Y |

* Non-residents are not subject to LIT.

| Deductible items | Deductible for: | |

| NIT | LIT | |

| Personal deduction (exemption) | Y | Y |

| Employment income deduction | Y | Y |

| Capital gains deduction | Y | Y |

| Occasional income deduction | Y | Y |

| Casualty losses | Y | Y |

| Medical expenses | Y | Y |

| Social insurance premiums | Y | Y |

| Life insurance premiums | Y | Y |

| Nursing medical insurance | Y | Y |

| Individual pension plan premiums | Y | Y |

| Earthquake insurance premiums | Y | Y |

| Contributions on or donations to national or local government bodies, and so on in Japan, or certain specified political donations | Y | Y** |

** Not deductible but tax credit is available for the Local Inhabitant Tax under some conditions.

National income tax

Income items subject to tax:

| Income Item | General taxable amount | Is a loss in this category deductible? |

| Employment income | Gross compensation | N/A |

| Business income | Gross receipts less necessary expenses | Yes |

| Rental income from real estate | Gross receipts less necessary expenses | Yes, but limited to domestic property only when overseas depreciation is computed under accelerated method. |

| Dividend income | Gross receipts less interest on borrowings to acquire principal | No but offset with other dividend income |

| Capital gains(except from securities, land and buildings) | 100 percent of short-term gains and 50 percent of long-term gains (after special deduction) | Yes |

| Occasional income | 50 percent of gross receipts less necessary expenses and special deduction | No but offset with other occasional income |

| Miscellaneous income (e.g. pension) | Gross receipts less necessary expenses | No but offset with other misc. income |

| Interest income | Gross receipts | N/A |

| Retirement income | Gross receipts | N/A |

| Income from forestry | Gross receipts less necessary expenses | Yes |

Intra-group statutory directors

Will a non-resident of Japan who, as part of their employment within a group company, is also appointed as a statutory director (i.e. member of the Board of Directors in a group company situated in Japan) trigger a personal tax liability in Japan, even though no separate director's fee/remuneration is paid for their duties as a board member?

If they are a registered director of a Japanese company, all compensation received as a director will be considered as Japan source and subject to Japan income taxes at 20.42 percent. The Japanese company has withholding obligations if it is paid via Japanese payroll.

a) Will the taxation be triggered irrespective of whether or not the board member is physically present at the board meetings in Japan?

Yes.

b) Will the answer be different if the cost directly or indirectly is charged to/allocated to the company situated in Japan (i.e. as a general management fee where the duties rendered as a board member is included)?

Yes.

c)In the case that a tax liability is triggered, how will the taxable income be determined?

All compensation paid as a director will be taxable in Japan.

Tax-exempt income

Are there any areas of income that are exempt from taxation in Japan? If so, please provide a general definition of these areas.

Certain employer provided housing allowances (employer's contribution to rent)

Taxable. However, if below conditions are met, the housing allowance paid by the employer is not taxable.

- the contractor of the house is the company and rent is paid by the company to the owner directly

- the assessed rent at least 50 percent of assessed rent (which is usually close to 5-10 percent of actual rent) is deducted/paid by the employee.

Above exception may apply to board members/directors, however the formula to calculate the assessed rent differs from the employee calculation method depends on the nature of the house (luxury, size, owner of the house).

Certain employer provided housing allowances (cost of utilities)

Taxable.

Living away from home allowance (LAFHA)

Taxable.

Certain employer provided tax reimbursements

Taxable. Any tax reimbursements or settlements made by an employer for an expatriate should be included in taxable income.

Certain employer provided relocation reimbursements

Non-taxable. Reimbursements of actual moving cost in connection to the assignee's relocation to/from Japan are generally non-taxable.

Home leave

Taxable. Subject to certain conditions, non-taxable. Cash or an in-kind benefit provided by an employer to an expatriate in Japan to facilitate a home leave trip to that expatriate's and/or spouse's country/jurisdiction of origin can generally not be treated as taxable income. The home leave expenses can also cover the costs of the expatriate's co-habiting family members.

Such home leave should, generally, be limited to a single trip per year and should be in accordance with the employer's working rules, terms of the expatriate's contract and so on. Further, the expenses should be reasonable based upon the relevant facts, such as available routes, distances, fares, and so on.

Certain employer provided education costs

Taxable. Tuition fees for children paid by an employer are taxable to the employee. However, an exception to such taxable treatment has been established by special tax rulings with respect to the contribution plan of certain international schools in Japan. Under such plans, an employer company can effectively make a donation to the school and in recognition of this children of employees are exempt from tuition fees for attending the school. The employees are not required to report any benefit arising from this arrangement as taxable income.

However, employer companies are required to treat the contribution payments as donations for corporate income tax purposes. Donations have only limited deductibility for corporate tax purposes. Certain international schools have now been granted status as Specified Public Interest Facilitating Corporations (SPIFC). As a result, it may be possible for companies to enjoy a tax deduction for a greater portion of donations to such qualifying schools.

Certain bonus payments

Taxable.

Certain interest subsidies

Taxable.

Certain auto allowances

Taxable. However, a company car used purely for the employer's business purposes can be treated as a non-taxable economic benefit.

Commutation allowance

Non-taxable. A commutation (transportation) allowance may be paid tax free up to lesser of JPY150,000 or the actual monthly transportation costs.

Expatriate concessions

Are there any concessions made for expatriates in Japan?

See residency rule section.

Non-resident salary earned from working abroad

Is salary earned from working abroad taxed in Japan? If so, how?

Non-resident status taxpayer

The salary earned from working abroad is not taxed in Japan.

Non-permanent resident status taxpayer

Since employment income is considered to arise at the location at which employment services are rendered, income corresponding to employment services while expatriates are traveling outside Japan is treated as foreign-sourced income. The income allocation is based on the number of days spent on business outside Japan. The day of departure from Japan is not counted as a day of absence from Japan but the day of return to Japan is counted as an absent day. Where expatriates take home leave, the number of such days spent outside Japan is eliminated from the computation used to allocate employment income. Generally speaking, a non-permanent resident would not be taxed on the portion of income that relates to services performed abroad. Please note that the income allocation is not applied for a registered director of Japanese company.

However, Japan applies a remittance exception whereby an expatriate is taxable on compensation paid in Japan and/or remitted to Japan, if such amount exceeds the amount of income attributed to services in Japan.

Therefore, it is necessary for a non-permanent resident taxpayer to keep record of remittances to Japan in cases where of their compensation is paid outside Japan.

Taxation of investment income and capital gains

Are investment income and capital gains taxed in Japan? If so, how?

Capital gains representing income derived from the sale or transfer of land or buildings (including the right to use land) are divided into two categories: short-term gains from land and buildings held for no longer than 5 years as of 1 January of the transaction year, and long-term gains from those held over 5 years as of 1 January of the transaction year.

Long-term gains are taxed at a flat rate of 15.315 percent (including surtax) of national income tax plus 5 percent of local inhabitant tax.

Short-term gains are taxed at a flat rate of 30.63 percent (including surtax) of national income tax plus 9 percent of local inhabitant tax.

The sale of land or buildings held by non-residents is calculated same as resident taxpayers and subject to 10.21 percent (including surtax) withholding tax except if the property has been purchased by individuals for residential use and the sales value is no more than JPY100 million.

The rate of the separate assessment tax of capital gain of stocks is 20.315 percent (15.315 percent national (including surtax) and 5 percent local).

Dividends, interests, and rental incomes

In principle, these should be reported on an individual income tax return unless the tax is withheld when it's paid.

Gains from stock option exercises

In general, stock options are taxed in Japan at the time of exercise. Gains from stock option exercises are taxable as an employment income.

| Residency status | Taxable at: | ||

| Grant | Vest | Exercise | |

| Resident | N | N | Y |

| Non-resident | N | N | Y |

| Other (if applicable) | N/A | N/A | N/A |

Foreign exchange gains and losses

Technically, gains and losses on foreign exchange should be included as miscellaneous income on the individual tax return.

Principal residence gains and losses

If following conditions are met, the special tax assessment of principal residence gain may apply.

- The principal residence is in Japan.

- The ownership period exceeds 10 years as of 1 January of the sale year.

- The taxpayer did not apply this special tax treatment in past 2 years.

- Another tax treatment is not applied upon the sale of residential property.

- The sale is not made to the close relatives.

Gains on the sale of residential property is taxed at 10.21 percent (including surtax, plus 4 percent local inhabitant tax) of taxable gains up to JPY60 million and 15.315 percent (including surtax, plus 5 percent local inhabitant tax) on the excess over JPY60 million. A special deduction of JPY30 million is available on gains from the sale of residential property if specified conditions are met.

Under some conditions, the carryover of the capital loss is applicable for up to 3 years.

Capital losses

Generally, capital loss carryover / carryback is not applicable in Japan except under some conditions. Capital loss from listed stock transaction can be offset with listed stock dividend and interest income.

The carryover of capital loss of listed stocks through a broker registered in Japan is applicable for up to 3 years.

Personal use items

Not applicable in Japan.

Gifts

See Gift, Wealth, Estate, and/or Inheritance Tax Section.

Additional capital gains tax (CGT) issues and exceptions

Are there additional capital gains tax (CGT) issues in Japan? If so, please discuss?

Retirement income

Retirement income is taxed separately from other income, and the payer of retirement income in Japan is required to withhold both national income and local inhabitant taxes at source.

The taxable retirement income is 50 percent of the net of the gross receipts less the retirement deduction based on the length of service:

| Length of service | Retirement deduction (JPY) |

| Up to 20 years of service | 400,000 per year of service or 800,000 (whichever is greater) |

| Over 20 years of service | 8,000,000 + 700,000 per year of service after 20 years |

However, for directors defined under the Corporation tax law whose years of service are 5 years or less, the taxable retirement income is the net of the gross receipts less the retirement income deduction.

Pre-CGT assets

Not applicable.

Deemed disposal and acquisition

Exit tax

A special tax regime, exit tax, to impose income tax on unrealized capital gains on financial assets held at departure from Japan was introduced. The exit tax is effective for covered individual departing Japan on or after 1 July 2015.

Covered individuals:

A resident individual who meets both of the following conditions;

a. Has a total value of "financial assets" of JPY100 million or more at the time of departure; and

b. Has lived in Japan for more than 5 years* in the previous 10 years before departure

*The period during staying in Japan with a status of residence under Table 1 of the Immigration Control and Refugee Recognition Act can be excluded.

As a consequence, the exit tax will not apply to foreign expatriate employees staying in Japan unless the individual holds the status of residence under Table 2 of the Immigration Control and Refugee Recognition Act.

General deductions from income

What are the general deductions from income allowed in Japan?

The following deductions and allowances are available to permanent and non-permanent residents:

Employment income deduction: The deduction is taken against employment income only. The deduction amount is calculated as the higher of specific employment-related expenditure and the standard employment income deduction. The standard income deduction is found from the following table:

| From JPY | To JPY | Employment deduction JPY |

| 0 | 1,800,000 | The greater of (Gross income x 40%-100,000) or 550,000 |

| 1,800,001 | 3,600,000 | (Gross income x 30%) + 80,000 |

| 3,600,001 | 6,600,000 | (Gross income x 20%) + 440,000 |

| 6,600,001 | 8,500,000 | (Gross income x 10%) + 1,100,000 |

| 8,500,001 | No Limit | 1,950,000(cap) |

| 10,000,000 (Note*) | (Gross income x 10%) + 1,100,000 | |

| 10,000,001 | No Limit | 2,100,000(cap) |

(Note*) For a taxpayer who falls under any of the following:

A special handicapped person(Note*) For a taxpayer who falls under any of the following:

- A person having dependents aged less than 23 in the same household

- A person having special handicapped dependents or special handicapped spouse in the same household

If the aggregate amount of specific employment-related expenditures incurred but not reimbursed by the employer during a year which exceeds 50 percent of the employment income deduction, the excess may be deducted in addition to the employment income deduction. Specific expenditures include the following:

- commuting expenses

- moving expenses on transfer

- training expenses incurred in gaining technology or knowledge directly required for performing duties.

The expenditures must be documented and certified by the employer. The deduction of specific expenditures may only be claimed by filing a tax return as follows.

- Capital gains deduction: A special deduction of JPY500,000 is allowed against capital gains, which is subject to aggregate taxation. The deduction is applied first against short- term gains and then the remainder is applied against long-term gains.

- Occasional income deduction: A special deduction of JPY500,000 is allowed against net occasional income

- Casualty losses: The amount deductible against ordinary income is equivalent to the excess of the loss not covered by insurance proceeds over the smaller of JPY50,000 or 10 percent of adjusted total income.

- Medical expenses: The deductible amount is equivalent to the excess of medical expenses not covered by insurance proceeds over the smaller of JPY100,000 or 5 percent of adjusted total income. The maximum deductible amount is JPY2 million.

- Medical Expenses (self-medication): The deductible amount is up to JPY88,000 for portion exceeding JPY12,000 for the total expenses used for medical care costs certified for deduction. The proof of continuous effort in keeping health (e.g. periodic health check, vaccination, examination for cancer) would be required. If a taxpayer decides to apply Medical expense deduction from self-medication, normal medical expense deduction above would not be applied. This self-medication is currently applicable from 2017 to 2021.

- Social insurance premiums: The full amount of premiums paid by the employee under Japanese plans is deductible. In general, foreign social insurance premiums are not deductible.

- Life insurance premiums: For policies entered into after 31 December 2011 (new policies), the maximum deductible amount is JPY40,000 and JPY28,000 for national tax and local inhabitant tax respectively. An additional JPY40,000 (maximum for national tax) and JPY28,000 (maximum for local inhabitant tax) deductions are available if the premiums are paid under an individual pension plan / nursing insurance respectively. Foreign (non- Japanese) policies are not deductible. For policies entered into on or before 31 December 2011, the maximum deductible amount is JPY50,000 and JPY35,000 for national tax and local inhabitant tax respectively. If an individual applies for both old and new policies, the maximum deductible amount in total is JPY120,000 for income tax purpose and JPY70,000 for local inhabitant tax purpose.

- Earthquake insurance and/or long-term casualty insurance premiums: Earthquake insurance premiums up to the value of JPY50,000 can be deducted from income for income tax purposes, and a half of the premiums for local inhabitant tax purposes (up to JPY25,000). Although the income deduction for casualty insurance premiums is basically abolished from 2007, the deduction for long-term casualty insurance premiums will remain available provided that the policies are entered into before 31 December 2006. The maximum deduction for long-term casualty insurance premiums is JPY15,000 and JPY10,000 for income tax purposes and for inhabitant tax purposes respectively. If an individual applies for both a deduction for earthquake insurance premiums and a deduction for long-term casualty premiums, the maximum deductible amount in total is JPY50,000 for income tax purposes and JPY25,000 for inhabitant tax purposes.

- Contributions and donations: Contributions or donations made to tax qualified organizations such as government or local authorities, institutions for education, scientific, or other public purposes as designated by the Minister of Finance, and institutions for scientific study or research specifically provided for in the regulations are deductible. The deductible amount is equivalent to all qualified contributions exceeding JPY2,000 with some limitations based on income level. As for local inhabitant tax, not deduction but tax credit is available for contributions or donations qualified under local tax law.

- Basic deduction: The taxpayer is eligible for basic deduction as below.

| Resident's total income after standard employment income deduction (JPY) | Deductible amount (NIT) | Deductible amount (LIT) |

| 24,000,000 or less | 480,000 | 430,000 |

| More than 24,000,000 but 24,500,000 or less | 320,000 | 290,000 |

| More than 24,500,000 but 25,000,000 or less | 160,000 | 150,000 |

| More than 25,000,000 | 0 | 0 |

- Dependent deduction: Dependent deduction of JPY380,000 for NIT/JPY330,000 for LIT would be applicable for all dependents (whose net annual income is below JPY380,000) living in Japan whose age is 16 or above at year end. For dependents whose age is in between 19-22, this deduction would be JPY630,000 for NIT/JPY450,000 for LIT and for dependents aged over 70, JPY480,000 for NIT/JPY380,000 for LIT (if living separately) or 580,000 for NIT/JPY450,000 for LIT (if living together) would be applied.

- Spousal deduction: If a taxpayer's spouse is eligible for spousal deduction (ex. net annual income is below JPY380,000), taxpayer would be allowed for deduction based on the following table. If taxpayer's income after standard employment income deduction is more than JPY10,000,000 this deduction would not be applicable.

| Resident's total income after standard employment income deduction (JPY) | Deductible amount (NIT) | |

| For Spouse | For Elderly spouse | |

| 9,000,000 or less | 380,000 | 480,000 |

| more than 9,000,000 but 9,500,000 or less | 260.000 | 320,000 |

| More than 9,500,000 but 10,000,000 or less | 130,000 | 160,000 |

| More than 10,000,000 | 0 | 0 |

| Resident's total income after standard employment income deduction (JPY) | Deductible amount LIT) | |

| For Spouse | For Elderly spouse | |

| 9,000,000 or less | 330,000 | 380,000 |

| more than 9,000,000 but 9,500,000 or less | 220,000 | 260,000 |

| More than 9,500,000 but 10,000,000 or less | 110,000 | 130,000 |

| More than 10,000,000 | 0 | 0 |

Overseas Dependent Deduction: If a taxpayer would claim deduction for spouse/dependents residing in overseas, submission of following documents would be required. Both documents need to be submitted along with Japanese translations.

1. Documents proving family members are relatives of the taxpayer

2. Documents for money transfers

Tax reimbursement methods

What are the tax reimbursement methods generally used by employers in Japan?

Current year gross-up, current year reimbursement, and 1-year rollover (under certain conditions) are allowed. If compensation is paid in Japan, it is subject to withholding tax and a gross up would be required.

Calculation of estimates/ prepayments/ withholding

How are estimates/prepayments/withholding of tax handled in Japan? For example, Pay-As- You-Earn (PAYE), Pay-As-You-Go (PAYG), and so on.

Pay-as-you-go (PAYG) withholding

If compensation is paid to a resident or Japanese-sourced compensation is paid to a non- resident through onshore payroll, the employer is required to withhold income tax on the payments. If the employer of non-residents has an office or place of business in Japan and Japanese-sourced compensation is paid to non-residents outside of Japan, the office or place of business in Japan is required to withhold income tax on the payments.

PAYG installments

Not applicable.

When are estimates/prepayments/withholding of tax due in Japan? For example: monthly, annually, both, and so on.

Provisional national tax payments are determined based on the prior year's tax liability. In general, provisional tax is calculated as two-thirds of the preceding year's tax liability and is payable in two equal installments; 31 July and 30 November following Monday if these payment dates fall on Saturday, Sunday and National holiday. In mid-June, the tax office will send taxpayers a notice with the relevant provisional tax amounts and due date.

Under certain circumstances, the application of reduction of provisional tax payment is applicable.

Relief for foreign taxes

Is there any Relief for Foreign Taxes in Japan? For example, a foreign tax credit (FTC) system, double taxation treaties, and so on?

A tax credit can be applicable to resident taxpayers who have foreign-source income on which both foreign and Japanese taxes have been paid. The credit limitation is calculated by the following formula:

| Type | Credit calculation |

| Japanese income tax | (A) |

| Foreign-sourced income | (B) |

| Entire income taxable in Japan | (C) |

| Credit limitation: | (A) x {(B) / (C)} |

The excess of the foreign tax over the credit limitation calculated as above can be carried forward for 3 successive years.

General tax credits

What are the general tax credits that may be claimed in your country/jurisdiction? Please list below.

There is a host of credits that may be claimed against the taxpayer's regular tax liability, such as:

- tax credit for dividends from Japanese companies

- special tax credit for mortgage loan interest

- special tax credit for contributions to political parties

- special tax credit for anti-earthquake improvement

- foreign tax credit

- special tax credit for contributions to tax qualified non-profit organization.

Sample tax calculation

This calculation assumes a married taxpayer resident in Japan with two children whose 3- year assignment begins 1 January 2019 and ends 31 December 2021. The taxpayer's base salary is 100,000 US dollars (USD) and the calculation covers 3 years.

| 2019 USD | 2020 USD | 2021 USD | |

| Salary | 100,000 | 100,000 | 100,000 |

| Bonus | 20,000 | 20,000 | 20,000 |

| Cost-of-living allowance | 10,000 | 10,000 | 10,000 |

| Housing allowance | 12,000 | 12,000 | 12,000 |

| Company car | 6,000 | 6,000 | 6,000 |

| Moving allowance | 20,000 | 0 | 0 |

| Home leave | 0 | 5,000 | 0 |

| Education allowance | 3,000 | 3,000 | 3,000 |

| Interest income from non-local sources | 6,000 | 6,000 | 6,000 |

Exchange rate used for calculation: USD1.00 = JPY100.00.

Other assumptions

- All earned income is attributable to local sources.

- Bonuses are paid at the end of each tax year and accrue evenly throughout the year.

- Interest income is not remitted to Japan.

- The company car is used for private purposes.

- The employee is deemed resident throughout the assignment.

- Tax treaties and totalization agreements are ignored for the purpose of this calculation.

Additional Assumptions

- spouse: no income

- children: age 10 years old/age 8 years old

- taxpayer is not a Japanese national and resided in Japan for more than 1 year and less than 5 years in the last 10 years

- taxpayer leaves Japan on 31 December 2021

- taxpayer lives in Tokyo during Japan assignment.

Calculation of taxable income

| Year-ended | 2019 JPY | 2020 JPY | 2021 JPY |

| Earned income subject to income tax | Days in Japan during year | ||

| 365 | 366 | 365 | |

| Salary | 10,000,000 | 10,000,000 | 10,000,000 |

| Bonus | 2,000,000 | 2,000,000 | 2,000,000 |

| Cost-of-living allowance | 1,000,000 | 1,000,000 | 1,000,000 |

| Net housing allowance | 1,200,000 | 1,200,000 | 1,200,000 |

| Company car | 600,000 | 600,000 | 600,000 |

| Moving allowance | 2,000,000 | 0 | 0 |

| Home leave | 0 | 500,000 | 0 |

| Education allowance | 300,000 | 300,000 | 300,000 |

| Tax reimbursement (national tax) | 0 | 4,416,700 | 6,201,100 |

| Tax reimbursement (inhabitant tax) | 0 | 1,259,500 | 1,877,000 |

| Total earned income | 15,100,000 | 21,276,200 | 23,178,100 |

| Other income | 0 | 0 | 0 |

| Total income | 15,100,000 | 21,276,200 | 23,178,100 |

| Employment Income Deduction | 2,200,000 | 2,100,000 | 2,100,000 |

| Deductions: | 380,000 | 480,000 | 480,000 |

| Total taxable income | 12,520,000 | 18,696,000 | 20,598,000 |

Calculation of tax liability

| 2019 JPY | 2020 JPY | 2021 JPY | |

| Taxable income as above | 12,520,000 | 18,696,000 | 20,598,000 |

| Japanese tax thereon | 2,650,100 | 4,780,700 | 5,557,500 |

| Less: | |||

| Domestic tax rebates (dependent spouse rebate) | 0 | 0 | 0 |

| Foreign tax credits | 0 | 0 | 0 |

| Provisional tax | 0 | (1,766,600) | (3,187,000) |

| Final tax due (national) | 2,650,100 | 3,014,100 | 2,370,500 |

| Inhabitant tax | 1,259,500 | 1,877,000 | 0 |

| Total Japanese tax | 3,909,600 | 6,657,700 | 5,557,500 |

Back to top

FOOTNOTES:

1Certain tax authorities adopt an "economic employer" approach to interpreting Article 15 of the OECD model treaty which deals with the Dependent Services Article. In summary, this means that if an employee is assigned to work for an entity in the host country/jurisdiction for a period of less than 183 days in the fiscal year (or, a calendar year of a 12-month period), the employee remains employed by the home country/jurisdiction employer but the employee's salary and costs are recharged to the host entity, then the host country/jurisdiction tax authority will treat the host entity as being the "economic employer" and therefore the employer for the purposes of interpreting Article 15. In this case, Article 15 relief would be denied, and the employee would be subject to tax in the host country/jurisdiction.

2For example, an employee can be physically present in the country/jurisdiction for up to 60 days before the tax authorities will apply the 'economic employer' approach.

Gross compensation includes salaries, wages, bonuses, and other allowances of a similar nature. Benefits-in-kind provided by the employer are also included in employment income. Compensation earned outside Japan is treated differently depending on an employee's residency: Non-permanent resident: Since employment income accrues from the place where employment services are rendered, income corresponding to services rendered while a non-permanent resident employee is traveling outside Japan is treated as income from sources abroad. The amount of such income is required to be calculated based on the number of days spent on business outside Japan, and in connection therewith, the day of departure from Japan is not counted as absence from Japan while the day of return to Japan is counted as absence from Japan. Moreover, when an expatriate takes home leave, the number of such days spent outside Japan is required to be completely eliminated from the computation of allocation of employment income to sources abroad and in Japan. Non-resident: A non- resident is not taxed on any earnings from non-Japanese sources, regardless of where paid or remitted.

3Interest expenses on the acquisition of land included in a loss in connection with calculation of rental income from real estate cannot be deducted from other income.

4Property held 5 years or less is considered short-term; all other property is long-term.

Special considerations for short-term assignments

Residency rules

Payroll considerations

Taxable income

Additional considerations

For the purposes of this publication, a short-term assignment is defined as an assignment that lasts for less than 1 year.

Residency Rules

Are there special residency considerations for short-term assignments?

Not applicable.

Payroll considerations

Are there special payroll considerations for short-term assignments?

Not applicable.

Taxable income

What income will be taxed during short-term assignments?

Japanese-sourced income.

Additional considerations

Are there any additional considerations that should be considered before initiating a short- term assignment in Japan?

Generally, Japan's double tax treaties are in line with the OECD Model Treaty with respect to the tax-exempt treatment of foreign employees temporarily working in Japan. Such employees are generally tax exempt if they fulfill the following three criteria:

- they are present in Japan for not more than 183 days in any 12-month period commencing or ending the fiscal year concerned

- their salary is paid by a non-resident employer

- none of the salary is borne by a permanent establishment in Japan.

Back to top

Other taxes and levies

Social security tax

Are there social security/social insurance taxes in Japan? If so, what are the rates for employers and employees?

Employer (as of 1 April 2020)

| Type of insurance | Basis | Contribution (%) | Maximum premium (JPY) |

| Health insurance: | Monthly | Monthly maximum | |

| On salaries: | 4.92 | 68,388 | |

| If 40 years old or older | 5.82 | 80,898 | |

| On bonuses: | 4.92 | 281,916* | |

| If 40 years old or older | 5.82 | 333,486* | |

| Welfare pension insurance: | Monthly | ||

| On salaries | 9.15 | 59,475 | |

| On bonuses | 9.15 | 137,250 | |

| Employment insurance: | Total payroll | 0.600 | No limit |

| Workmen's accident compensation insurance: | Total payroll | ||

| Manufacturing | 0.250-2.600 | No limit | |

| Other business | 0.25-8.8 | No limit |

* Maximum per year (from April 1st to March 31st, following year).

Employee (as of 1 March 2021)

| Type of premium | Basis | Contribution (%) | Maximum premium (JPY) |

| Health insurance: | Monthly | Monthly maximum | |

| On salaries: | 4.92 | 68,388 | |

| If 40 years old or older | 5.82 | 80,898 | |

| On bonuses: | 4.92 | 281,916* | |

| If 40 years old or older | 5.82 | 333,486* | |

| Welfare pension insurance: | Monthly | ||

| On salaries | 9.15 | 59,475 | |

| On bonuses | 9.15 | 137,250 | |

| Employment insurance: | Total payroll | 0.300 | No limit |

| Workmen's accident compensation insurance: | Total payroll | ||

| Manufacturing | None | N/A | |

| Other business | None | N/A |

* Maximum per year (from April 1st to March 31st, following year).

Social insurance

The social insurance program in Japan consists of health insurance, nursing care insurance, pension insurance, employment insurance and workmen's accident compensation insurance.

Health insurance is a system of paying medical care benefits and allowances to employees and their families.

The Employees' Pension Insurance System aims to guarantee a stable life to the employees and their families by paying them benefits when the employees retire are disabled due to illness or injury, or in the event of their death.

Every individual who meets the prescribed conditions is expected to participate in these systems as an insured person, regardless of nationality. Individuals who are paid from outside of Japan are generally not required to participate in these systems.

Non-Japanese employees that leave Japan can claim a refund of employee national pension contributions. The employee must have paid contributions for at least 6 months to be eligible for the refund. Refunds will be given for up to 3 years of contributions. The amount of the refund depends on how long the employee made contributions and the average standard monthly remuneration.

The maximum standard remuneration for purposes of calculating the refund is JPY620,000.

Japanese governmental health, nursing, welfare pension, and employment insurance premiums are deductible in calculating taxable income. Generally, it should be noted that foreign social insurance premiums are not deductible.

Gift, wealth, estate, and/or inheritance tax

Are there any gift, wealth, estate, and/or inheritance taxes in Japan?

The gift tax is imposed on taxable properties acquired by gift in a calendar year less an annual exemption of JPY1.1 million. A donee domiciled in Japan is taxed on all gifts of property regardless of their location. A donee that does not have a domicile in Japan is basically taxable only on gifts of property located in Japan at the time of the gift. (If the donee is a Japanese national, an exceptional rule can be applied.)

Gift tax for (1) general gift and (2) special gift are calculated separately.

(1) General gift: Gift other than special gift.

(2) Special gift: Gift from the lineal ascendant (usually the parent or the grandparent by blood) to the donee at age 20 or over as of 1 January of the year the gift was made.

| Aggregated net taxable value after JPY1.1 million deduction | For (1) General gift tax | |||

| Over | Up to | Multiplication amount | Subtraction amount | |

| 0 | 2,000,000 | 10% | 0 | |

| 2,000,000 | 3,000,000 | 15% | 100,000 | |

| 3,000,000 | 4,000,000 | 20% | 250,000 | |

| 4,000,000 | 6,000,000 | 30% | 650,000 | |

| 6,000,000 | 10,000,000 | 40% | 1,250,000 | |

| 10,000,000 | 15,000,000 | 45% | 1,750,000 | |

| 15,000,000 | 30,000,000 | 50% | 2,500,000 | |

| 30,000,000 | No limit | 55% | 4,000,000 | |

| Aggregated net taxable value after JPY1.1 million deduction | For (2) Special gift tax | |||

| Over | Up to | Multiplication amount | Subtraction amount | |

| 0 | 2,000,000 | 10% | 0 | |

| 2,000,000 | 4,000,000 | 15% | 100,000 | |

| 4,000,000 | 6,000,000 | 20% | 300,000 | |

| 6,000,000 | 10,000,000 | 30% | 900,000 | |

| 10,000,000 | 15,000,000 | 40% | 1,900,000 | |

| 15,000,000 | 30,000,000 | 45% | 2,650,000 | |

| 30,000,000 | 45,000,000 | 50% | 4,150,000 | |

| 45,000,000 | No limit | 55% | 6,400,000 | |

Inheritance tax and gift tax are levied on an heir who acquired properties by inheritance and an individual (a donee) who acquired properties from another individual (a donor) as a gift, respectively. The scope of taxable properties depends on whether the individuals have or had domicile in Japan and whether they hold Japanese nationality.

Under the 2017 tax reform, the scope of the tax payment obligations of inheritance tax/gift tax was amended in that inheritance tax/gift tax will not be imposed on properties located outside Japan with respect to inheritance/gifts involving foreign nationals living or having lived temporarily in Japan under certain conditions.

However, the 2017 tax reform also included amendments to expand the scope of taxable properties for cases where a foreign national living outside Japan (an heir/donee) obtains properties from a foreign national who had lived in Japan for more than 10 years (a decedent/donor) within 5 years after the decedent/donor left Japan.

Certain exemptions and allowances are permitted in the computation of taxable property.

Inheritance tax rates range from 10 percent to 55 percent, with a 20 percent surtax on transfers to non-family heirs, as follows:

| Over | Up to | Multiplication amount | Subtraction amount |

| 0 | 10,000,000 | 10% | 0 |

| 10,000,000 | 30,000,000 | 15% | 500,000 |

| 30,000,000 | 50,000,000 | 20% | 2,000,000 |

| 50,000,000 | 100,000,000 | 30% | 7,000,000 |

| 100,000,000 | 200,000,000 | 40% | 17,000,000 |

| 200,000,000 | 300,000,000 | 45% | 27,000,000 |

| 300,000,000 | 600,000,000 | 50% | 42,000,000 |

| 600,000,000 | No limit | 55% | 72,000,000 |

Real estate tax

Are there real estate taxes in Japan?

The sale or other transfer of real estate is subject to real estate registration tax. The owners of property (including land, building and depreciable tangible assets) as of 1 January of each year are subject to a fixed property tax.

Sales/VAT tax

Are there sales and/or value-added taxes in Japan?

Consumption tax is imposed on goods and services at all levels. The tax rate is 10 percent (including 2.2 percent for local consumption tax).

Unemployment tax

Are there unemployment taxes in Japan?

Please see Social Security Tax Section.

Other taxes

Are there additional taxes in Japan that may be relevant to the general assignee? For example, customs tax, excise tax, stamp tax, and so on.

Local inhabitant tax – self employment

Resident individuals who are self-employed are subject to a local enterprise tax on income from businesses or professions within Japan at rates ranging from 3 to 5 percent, depending on the type of business.

Foreign Financial Assets

Is there a requirement to declare/report offshore assets (e.g. foreign financial accounts, securities) to the country/jurisdiction's fiscal or banking authorities?

1. Overseas Assets Reporting: Permanent resident for Japanese tax purposes as of the end of the calendar year who own overseas assets over 50M yen as of the end of the calendar year has a reporting requirement of Overseas Assets to the Tax Authority.

2. Assets & Liabilities: Taxpayer filing tax return whose total income exceeds 20M yen for a calendar year AND a) total value of assets as of the end of the calendar year is 300M yen or more OR b) total value of financial assets as of the end of the calendar year is 100M yen or more has a reporting requirement of Assets and Liabilities (world-wide basis) to the Tax Authority.

Back to top

Immigration

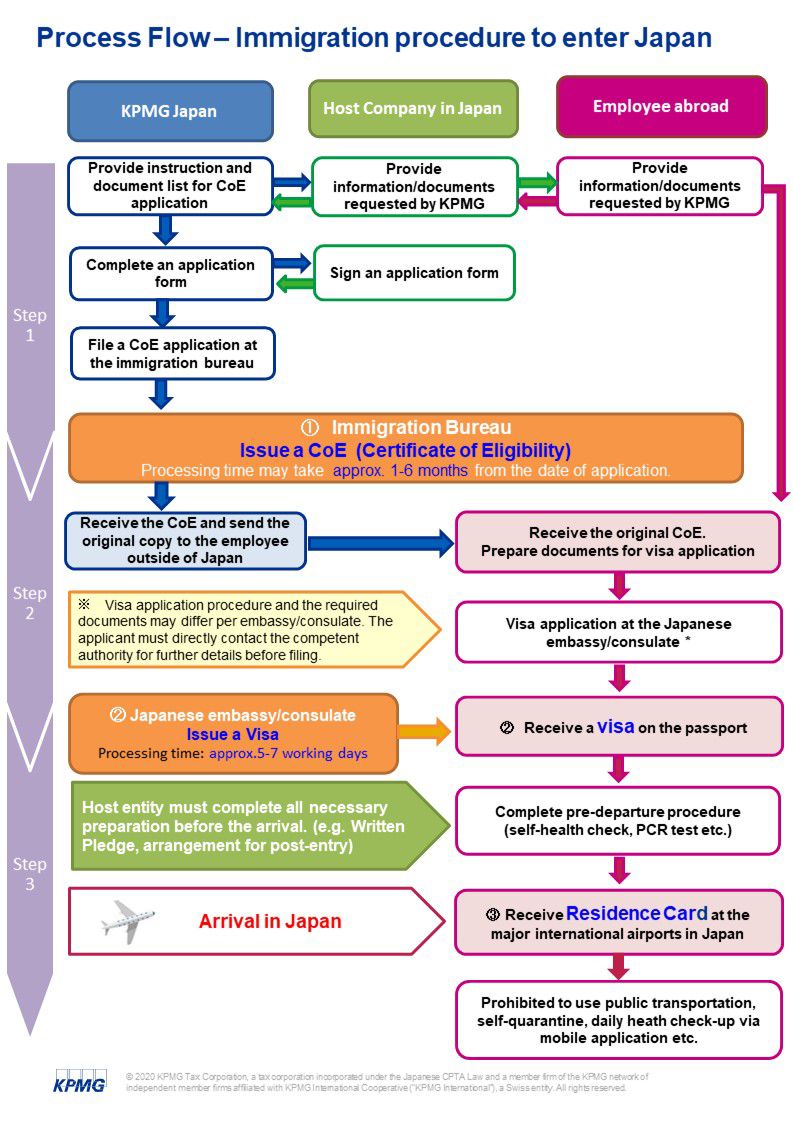

Following is an overview of the concept of Japan's immigration system for skilled labor.

(E.g. which steps are required, authorities involved, in-country/jurisdiction and foreign consular processes, review/draft flow chart illustrating the process)

This summary provides basic information regarding immigration status for work in Japan. The information is of a general nature and should not be relied upon as legal advice.

To enter Japan for work purposes, all foreign nationals are required to obtain a CoE (Certificate of Eligibility) issued by the Immigration Bureau in Japan to be entitled to apply for an appropriate type of work visa at the competent Japanese embassy/consulate in the country/jurisdiction of residence of the applicant.

The CoE application must be filed to the competent regional Immigration Bureau where located the host company. The processing time for the issuance of CoE may significantly differs according to the type of CoE and category (=size of business) of host company in Japan. It may take from 1 to 6 months from the date of application.

The granted permitted period of stay is determined by the examination of authority and it varies from 3 months, 1 year, 3 years or 5 years max. It is granted according to the category of Host Company (a newly established or size of business etc.), and the expected duration of assignment/employment etc.

The CoE has a validity of 3* months from the date of issuance and the foreign employer must apply for a visa and enter Japan with a validity of CoE. The foreigner entered with a valid visa and CoE will received a Residence Card at the major airports (New Chitose, Haneda, Narita, Chubu, Kansai,

Hiroshima, and Fukuoka airports) at the immigration control upon arrival. *

Note: Due to the entry ban, all foreign new arrivals are not allowed to enter Japan regardless to the nationality, departure country and/or duration of stay. (As of 28 May 2021)

All visa applications at the competent Japanese embassy/consulate are suspended until further notice.

Note: Validity of CoE differs according to the date of issue during the pandemic as below. The maximum validity might be extended if the period of entry ban is prolonged.

CoE issued between 01 January 2020 - 31 July 2021: valid until 31 January 2022

CoE issued between 01 August 2021 - 31 January 2022 : valid for 6 months from the date of issue

Note: Non-resident foreign nationals with "special exceptional circumstances" can be exceptionally granted permission to enter Japan unless the travelers have not stay in any of the denied countries/regions within 14 days prior to landing in Japan. Those special cases include medical or other emergencies, spouse of child of Japanese and/or permanent foreign residents, and exceptional situations such as childbirth or a funeral of a relative. The case of special exceptional circumstances will be verified at the authority independently.

Countries/regions of denied entry: http://www.moj.go.jp/isa/content/001347332.pdf

Special exceptional circumstances: http://www.moj.go.jp/isa/content/001347332.pdf

[Border enforcement measures to prevent the spread of Covid-1]

You must fulfill the entry requirements prior to departing Japan and comply the post-arrival quarantine May measure. The guidance is based on the current travel restriction as of 28 May 2021. Over the last year, travel restrictions due to COVID-19 have been fluid and rapidly changing in response to protecting public health. You should check the latest information before the departure.

1. Daily temperature for 14-days prior to the departure to Japan. Travel restriction due to Covid-.

You must check the temperature for 14 days prior to the departure and if any of common symptoms of COVID-19 including fever of 37.5°C or higher, respiratory symptoms, strong feeling of weariness (fatigue) are recognized, it is necessary that the trip to Japan be cancelled. It is not necessary to submit the result of this health monitoring for 14 days prior to the departure before travelling to Japan. Instead this result must be correctly filled in the questionnaire form distributed on the flight.

2. PCR test within 72 hours before departure

You must take PCR test within 72 hours before departing for Japan and must obtain a Certificate of Testing for Covid-19 from a medical facility in your country providing a negative test. Use the format requested by the Japanese government. If you can't provide the certificate that fulfils the requirements (e.g. missing information etc.), your entry may be denied as falling under the relevant provision of the Immigration Control and Refugee Recognition Act. Please keep the original and make some copies. We recommend you take PCR for nasopharyngeal specimen test rather than saliva as it is more reliable, unless you have any difficulty to do so (e.g. there is no medical institution your nearby can provide the necessary procedure etc.).

3. Complete a Questionnaire during a flight to Japan

You will be asked to complete a Questionnaire and Heath Card.

4. Entry in Japan (Please read carefully the enclosed instructions for further information

[At the airport]

- You will receive a Residence Card* at the passport check upon arrival. (*If your duration of stay in Japan is less than 90 days, Residence Card will not be issued, but you are authorized to work and live in Japan with a valid CoE and Visa.)

- You must submit a copy of "Written pledge" and "questionnaire" to the airport quarantine office.

- The certificate of pre-entry PCR test result must be presented to the airport quarantine office and be submitted to the border control.

- Airport quarantine officer and the immigration officer will check installation and set-up of the necessary mobile applications [OEL, WhatsApp, COCOA, and mobile map application].

[Refrain from using public transportation upon]

- You are prohibited to use any public transportation including taxi for upon arrival.

[14-days self-quarantine]

- You must self-isolate for 14 days counting from the day after arrival.

- You must report to the authority via mobile applications about your health condition every day for 14 days counting from the day after arrival.

5. After the entry

Once completing 14 days self-quarantine, you may proceed the residence registration* at the local municipal office for the residence registration. (*If your duration of stay in Japan is less than 90 days, you are exempt from residence registration.) You are highly required to carry your original Residence Card at all times, including when you travel abroad. You must show your original valid Residence Card when you enter and/or exit Japan. If you fail to carry your Residence Card, you may be sentenced to a fine of up to ¥200,000. If you are asked to show your card to the police or immigration officers and refused to do so, you may receive up to 1 year or in jail or be fined up to ¥200,000.

See below flow chart (Annex1) for entering Japan with the CoE and visa.

Annex1

International Business Travel/Short-Term Assignments

Describe (a) which nationalities may enter Japan as non-visa national, (b) which activities they may perform and (c) the maximum length of stay. *3

Nationals and citizens of 68 countries/jurisdictions which have reciprocal visa exemption agreement with Japan, are eligible for short-term visit to Japan without a visa for activities allowed to Temporary Visitor. The duration of stay permitted without a Temporary Visitor Visa (TVV) differ according to the nationality and citizenship, from 15 days to 90 days. However, the national of Austria, Germany, Ireland, Liechtenstein, Mexico, Switzerland, and the UK can extend the period of stay for a further 90 days. A request for extension must be submitted at the nearest Immigration Bureau within the validity of the first 90 days period.

TVV exempt nationals receive a Landing Permission sticker on the passport and this is equivalent to the TVV. The foreigners are permitted to stay in Japan until the date of permitted date inscribed on the Landing Permission.

Note: All visa exemption arrangements and visa waiver registration arrangements are suspended for the time being due to the Covid-19 pandemic

| ASIA | Barbados | 90 days | Europe | ||||

| Brunei | 15 days | Chile | 90 days | Andorra | 90 days | Lithuania | 90 days |

| Indonesia | 15 days | Costa Rica | 90 days | Austria* | 90 days | Luxembourg | 90 days |

| Malaysia | 90 days | Dominican Republic | 90 days | Belgium | 90 days | Malta | 90 days |

| Singapore | 90 days | El Salvador | 90 days | Croatia | 90 days | North Macedonia | 90 days |

| South Korea | 90 days | Guatemala | 90 days | Cyprus | 90 days | Monaco | 90 days |

| Thailand | 15 days | Honduras | 90 days | Czech Republic | 90 days | Netherlands | 90 days |

| Hong Kong (SAR) | 90 days | Mexico* | 90 days | Denmark | 90 days | Norway | 90 days |

| Macao (SAR) | 90 days | Surinam | 90 days | Estonia | 90 days | Poland | 90 days |

| Taiwan | 90 days | Uruguay | 90 days | Finland | 90 days | Portugal | 90 days |

| Oceania | Middle East | France | 90 days | Romania | 90 days | ||

| Australia | 90 days | Israel | 90 days | Germany* | 90 days | San Marino | 90 days |

| New Zealand | 90 days | Turkey | 90 days | Greece | 90 days | Serbia | 90 days |

| North America | UAE | 30 days | Hungary | 90 days | Slovakia | 90 days | |

| Canada | 90 days | Africa | Iceland | 90 days | Slovenia | 90 days | |

| USA | 90 days | Lesotho | 90 days | Ireland* | 90 days | Spain | 90 days |

| Latin America and the Caribbean | Mauritius | 90 days | Italy | 90 days | Sweden | 90 days | |

| Argentina | 90 days | Tunisia | 90 days | Latvia | 90 days | Switzerland* | 90 days |

| Bahamas | 90 days | Liechtenstein* | 90 days | UK* | 90 days | ||

Overview of visa exemptions countries/jurisdiction: https://www.mofa.go.jp/j_info/visit/visa/short/novisa.html

Temporary visitor must demonstrate the following documents to prove the purpose and duration of stay as a temporary visitor:

- Passport, valid for at least 3 months beyond the expected arrival date.

- Booking confirmation for the return or onward journey

- Proof of accommodation in Japan (e.g. Hotel reservation receipt)

- Invitation letter issued by the Japanese entity to prove the reason of business trip, if possible.

The permitted activities for a temporary visitor are, for example:

- Attend meetings with business partners

- Attend internal meetings

- Attending exhibitions/taking order/negotiating and signing contract

- Client visits

- Perform certain sales and/or marketing activities

- Consulting with business associates

- Participate in conferences, seminars, and workshops, also in an active capacity (for example as a speaker at a conference or seminar or as a trainer in a workshop)

- Receive training (only if the duration is less than 90 days and the activities are limited to "learn" and not to perform any practical work activities.)

- Research the local market/independent investigation

- Observing business activities

NOTE! It is not allowed to receive any income from Japanese entity while staying under temporary visitor status nor perform hands-on work in Japan that could be considered as "remunerative" work.

Describe (a) the regulatory framework for business travelers being visa nationals (especially the applicable visa type), (b) which activities they may perform under this visa type and the (c) maximum length of stay.

Visa nationals are required to obtain a Temporary Visitor visa at the competent Japanese embassy/consulate in their home country/jurisdiction or the country/jurisdiction of residence before travelling to Japan.

The maximum period of stay for temporary visitor is up to 90 days.

In regard to the permitted activities and permitted duration of stay please see answers to question 2.

Outline the process for obtaining the visa type(s) named above and describe (a) the required documents (including any legalization or translation requirements), (b) process steps, (c) processing time and (d) location of application.

- Document gathering (1-2 weeks)

- Book visa appointment and contact the competent Japanese embassy/ consulate a (1 day/ some countries/jurisdiction do not require a booking.)

- Prepare Visa application (1-2 days)

- File Visa application with the competent Japanese embassy/ consulate (Processing time for the issuance of visa may significantly vary according to the nature of application and the competent embassy/consulate)

- Obtain Visa and travel to Japan (1 day)

GENERAL REQUIREMENTS FOR TEMPORAY VISITOR

Required documents differs as per the nature of application and the competent embassy/consulate. The applicant must check with the competent authority before the application.

The followings are only "general" documents must be submitted:

Documents needs to be provided in Japanese or English or the language of the applying country/jurisdiction.

- Valid passport (must be valid at least 3 months beyond the expected arrival date and with at least two blank adjacent pages.)

- Visa application form fully completed

- One passport-sized color photo taken within 6 months prior to the application

- Proof of current address in the applying country/jurisdiction

- Proof of legal residency status in the applying country/jurisdiction if the applicant is not a national of its country/jurisdiction

- Flight itinerary (round trip, flight number, all departure destinations cities, dates and times)

- Bank statement to prove the sufficient balance to cover all trip expenses

- Details of planned activities while in Japan

- Invitation letter from Japan

- Visa fee*

*Visa fees are determined by reciprocal arrangements between Japan and the country/jurisdiction of applicant's nationality. The fees change on 1 April each year.

Are there any visa waiver programs or specific visa categories for technical support staff on short-term assignments?

NO

Long-Term Assignments

What are the main work permit categories for long-term assignments to Japan? In this context please outline whether a local employment contract is required for the specific permit type.

There are mainly four types of CoE for highly and/or skilled labor:

- Highly Skilled Foreign Professionals (point-based system)

- Business Manager

- Intra-Company Transferee (ICT)

- Engineer / Specialist in Humanities / International Services

1. "Highly Skilled Foreign Professionals" is a special immigration status designed for talented foreign workers with advanced and specialized skills. The activities of the highly skilled foreign professionals are classified into three categories: "advanced academic research activities", "advanced specialized/technical activities" and "advanced business management activities". Points are awarded according to the applicant's educational and professional background, income and academic achievements and if the total points reach 70 points or more, the applicant should be considered to be entitled to apply for this type of CoE. All points are required to be proved by the written documents. It is applicable for both local employment and/or international assignment.

The standard CoE for work are "Business Manager", "ICT" and "Engineer/Specialist in Humanities/International Services" and are granted according to the job position, job description, career and/or academic background, and the type of assignment and/or employment contract.

2. Business Manager is for the executive managers (e.g. CEO, COO, CFO, Representative Director or any other directors). The foreign employer must be officially registered in the certificate of commercial registration in Japan and must have a proven career and academic background (e.g. MBA). It is available for both local employment and international assignment.

3. ICT is only for those Manager and/or highly skilled worker under international assignment who are seconded in Japan from the foreign group company (HQ, subsidiary, branch and or representative office) The assignee must be employed by the home company at least 1 year continuously prior to the assignment in Japan. It is highly required to provide the documents to prove the capital ties between home and host companies.

4. Engineer/Specialist in Humanities/International Services is for skilled and/or qualified worker and who engage in the field of science, engineering, IT, architecture, law, economics, international trade, sociology, humanities, interpreter/translator etc. This is available for both local employment and international assignment but in principle, the salary must be paid by Japanese entity. The foreign employee must have at least a university degree equivalent to at least a 4-year Japanese Bachelor's degree or relevant work experience of 10 years.

Provide a general process overview to obtain a work and residence permit for long- term assignments (including processing times and maximum validation of the permit).

1. Document gathering and preparation of CoE application form (2-3 weeks)

2. File CoE application at the competent Immigration Bureau (Processing time differs according to the type of CoE and category (=size of business) of host company. (It may vary from 1 month to 6 months)

3. Issue of CoE

4. Host company send the original copy of CoE to the foreign employee outside of Japan (2-3 days)

5. Prepare the visa application and contact competent embassy/consulate (1-3 days)

6. File a visa application in accordance to the type of CoE at the competent Japanese embassy/consulate in their home country/jurisdiction or the country/jurisdiction of residence. (Processing time for the issuance of visa takes approx.1 week.)

7. Obtain Visa and travel to Japan (1 day)

8. Receive Residence Card at the border control upon arrival in Japan (1day)

9. Within 14 days of settlement, complete the residence registration at the competent ward office (1 day)

Is there a minimum salary requirement to obtain a long-term work and residence permit for assignments? Can allowances be taken into account for the salary?

In general, it would be required that the foreign national must earn a salary equivalent to a comparable Japanese local employee in the Japanese company where the foreigner intends to work/ be based.

Is there a fast-track process which could expedite the visa/ work permit?

No, there is no such fast-track in Japan.

At what stage is the employee permitted to start working when applying for a long-term work and residence permit (assignees/ local hire)?

The employee is permitted to start working, once they arrive in Japan with a valid CoE and Visa and received a valid Residence Card at the airport.

Can a short-term permit/ business visa be transferred to a long-term permit in Japan?

Technically it is possible to transfer Temporary Visitor status to a long-term permit while staying in Japan by applying a Status Change to the immigration bureau. However, the authority is taking a narrow approach to especially for those TVV-exempt nationals enter (=relocate) into Japan before the issuance of CoE, and stay until when it's issued so that they can directly apply for a Status Change without going back to their country/jurisdiction for a visa application at the Japanese embassy.

Is it possible to renew work and residence permits?

CoE and Visa are not required to renew.

Residence Card must be renewed before its validity and the extension of application can be filed 3 months prior to the expiry date.

Is there a quota or system or a labor market test in place?

No.

General Immigration Related Questions

Would it be possible to bring family members to Japan?

Yes. The work visa holder can bring family members – spouse (=married couple) and children only.

Highly Skilled Foreign Professionals or their spouses are allowed to bring their parents in Japan under certain conditions:

- Where the parents will take care of a child younger than 7 years old of the highly skilled foreign professional or their spouse; or

- Where the parent will take care of a pregnant highly skilled foreigner professional or a pregnant spouse.

- Highly skilled foreign professional's household annual salary is 8 million yean or more.

- The parent(s) lives with the highly skilled foreign professionals

Is it possible to obtain a permanent residence permit?

Yes, if the applicant fulfills full requirements it is possible to obtain a permission for permanent residence in Japan. However, the requirements significantly differ according to the immigration status of applicant.

In principle, 10 years of consecutive residence in Japan including 5 years of residence under work visa or those granted according to the family status (spouse of Japanese national, long-term residence etc.)

There are however some cases do not require 10 years of residency in Japan for instance:

- Highly Skilled Foreign Professional who has continuously stayed in Japan for 3 years or more

- And/or those who stayed in Japan continuously 3 year or more and who is deemed to have a total of 70 points or more when calculating with reference to the situation at 3 years before the date of the application for permission for permanent residence

- Highly Skilled Foreign Professional who has continuously strayed in Japan for 1 year or more

- And/or those who stayed in Japan continuously 1 year or more, and who is deemed to have a total 80 points or more when calculating with reference to the situation at 1 year before the date of the application for permission for permanent residence.

What if circumstances change after the Work and Residence application process?

Any change in the term of the employment or personal situation, including job title, job role or salary may require that a new Employment Permit needs to be secured or an appropriate notification to be made.

How long can a permit holder leave Japan without their permit becoming invalid?

If the permit holder is returning to Japan within 12 months or before the validity of Residence Card (when its validity is shorter than 12 months), they must obtain a Special Re-entry Permit which can be issued at the airport at the departure. However, if the permit holder is returning to Japan more than 12 months, they must obtain a Re-Entry Permit at the immigration bureau prior to the departure.

In addition, it is highly required to return in Japan before the expiry date of Residence Card.

For permanent permit holder, further to the Re-Entry Permit, they must return to Japan within 5 years otherwise the permission becomes invalid.

Must immigration permissions be cancelled by the end of the assignment/employment?

No, there is no cancellation in regard to the CoE/Visa/Residence Card.

The foreign resident must cancel their residence registration at the competent ward office from 14 days before the departure.

He/she then must renounce a valid Residence Card at the border control at the airport upon departure.

Are there any penalties for individuals and/or companies in place for non-compliance with immigration law?

Penalties and sanctions significantly differ according to the nature of crime and duration of the violation of immigration law. It could apply to both the individual and the companies. Penalties could be imprisonment, deportation of the employees, restriction on re-entering Japan or monetary fines.

For instance:

Possible sanctions for the employee for illegal employment:

- Imprisonment of up to 3 years and/or

- Fine of up to 3 million Yen and/or

- Deportation

Possible sanctions for the Japanese company for illegal employment promotion crime:

- Imprisonment of up to 3 years for the company representative responsible and / or

- Fine of up to 3 million Yen and/or

- Possibility of denial of visas or residence permits for other foreign employees

Other Important Items

List any other important items to note, or common obstacles faced, in Japan when it comes to the immigration processes.

Below you will find a list of other important items to note and the most common obstacles:

- Required documents and processing time differs according to the category of Japanese host company. In particular, a newly established company must prepare number of documents including business plan, lease contract of office and specific photos of office etc.

- Pre-visit in Japan – In case of a newly established host company, the foreign applicant must visit Japan for a signature if there is no Japanese national in the office to sign the CoE application form. They must stay in Japan on the day of application at the immigration bureau.

- Translations - All foreign documents must be written in Japanese or English. Translation can be completed by any agency – no requirement to be an official translator

- Salary needs to be comparable to a salary of a Japanese employee

Back to top

Footnotes:

1http://www.moj.go.jp/content/001291262.pdf

2https://www.mofa.go.jp/j_info/visit/visa/short/novisa.html

https://www.mhlw.go.jp/content/000784136.pdf

https://www.mhlw.go.jp/content/000769988.pdf

https://www.mhlw.go.jp/content/000785226.pdf

https://www.mhlw.go.jp/content/000779125.pdf

Disclaimer

All information contained in this publication is summarized by KPMG Tax Corporation, a tax corporation incorporated under the Japanese CPTA Law and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. The information contained in this publication is based on the Japanese Individual Income Tax Law, the Enforcement Cabinet Order of the Individual Income Tax Law, and the Basic Administrative Ruling of the Individual Income Tax Law as of 30 April 2021.

What Else Besides Earnings Come With the Back Part

Source: https://home.kpmg/xx/en/home/insights/2021/09/japan-taxation-of-international-executives.html

0 Response to "What Else Besides Earnings Come With the Back Part"

Post a Comment